Digitalisation in Banking and Finance

Banking on a better digital experience

As more and more companies jump onto the digital transformation bandwagon, we look at what the digitisation process really means for businesses, particularly, the financial and banking sector.

Like other sectors, this industry is in the middle of a digital transformation right now. As consumer amend for convenient and secure mobile and online banking continues to grow, along with the acceleration of remote exchanges in light of COVID-19, digital transformation has become a necessity.

A successful digital workplace will require the digitising of all records, streamlining and automating business processes and determining how to provide remote access in a secure way. As organisations grow and expand, and remote working becomes more of a norm, companies need to ensure that geographically remote teams will have access to important records and documents in order to complete their tasks and reach their work targets.

Efficiency through digitisation

By having your records digitised you can improve your document management capabilities, streamline business processes and create better workflows for your remote teams. Placing your digitised files in a single virtual records system also reduces silos, and centralises your records storage.

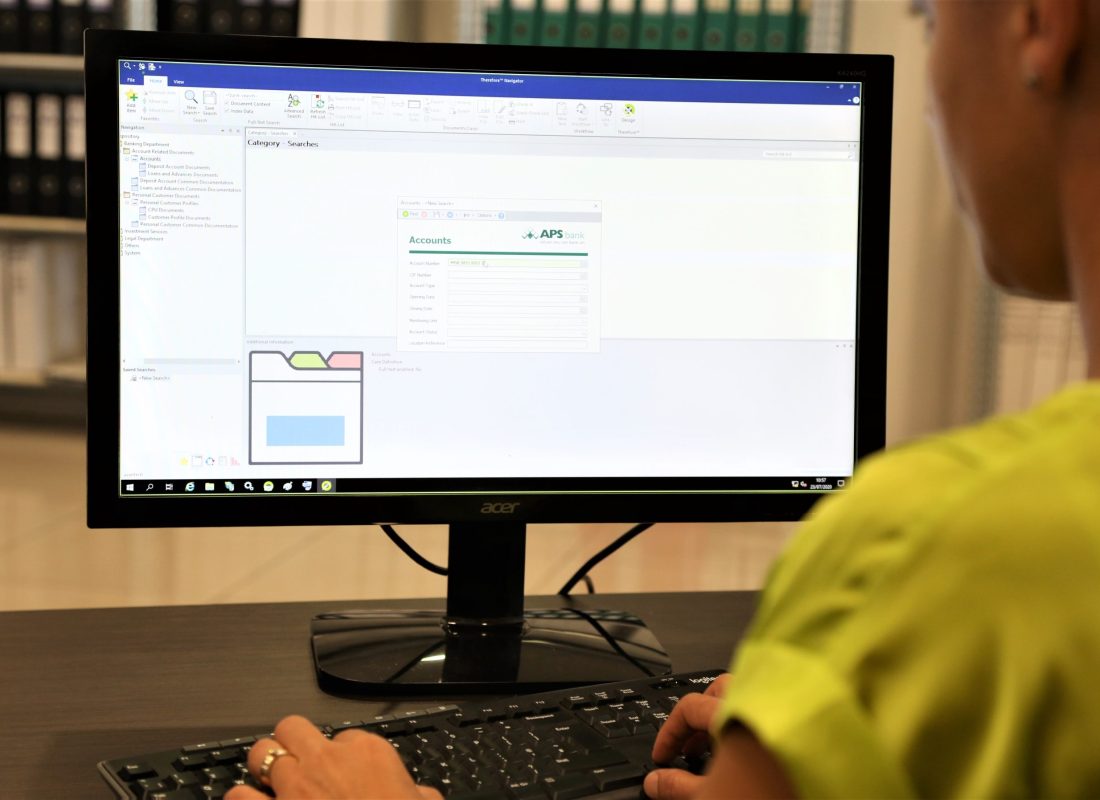

‘Therefore™ document management software interface’

Compliance is also of increasing concern, with every day that goes by. In Europe, the adoption of the General Data Protection Regulation (GDPR) imposes onerous fines on any organisation unfortunate enough to fall foul of the law. In the Financial Services sector, the additional rules and regulations governing everything, from Knowing Your Customer (KYC) to Anti-Money Laundering (AML) and many others, put massive pressures on these institutions.

What this means is that banks and other financial institutions need a processing and legacy system which

reconciles cheques and posts them into the system, and which can integrate with the bank’s digital channels in a more streamlined and efficient manner. This will require a more sophisticated system

for storing your documents—one that can scale out across your locations and give you access to documents anywhere, anytime. You also need to consider the automation factor as process to digital will require a concrete plan for your electronic documents. Chances are, most of the documents you receive today are already in electronic format. You can use your digital transformation project to add automation for capturing documents—so you don’t even have to think about it.

The digital backup of documents enables companies to take control of their business continuity plans. With all the information securely stored in the cloud, companies can not only mitigate security threats, but also create the business processes that simplify time-consuming tasks, freeing up employees to contribute to more important work that drives company growth and profits as well as creating a paperless office.

Digitising APS Bank through a bespoke solution

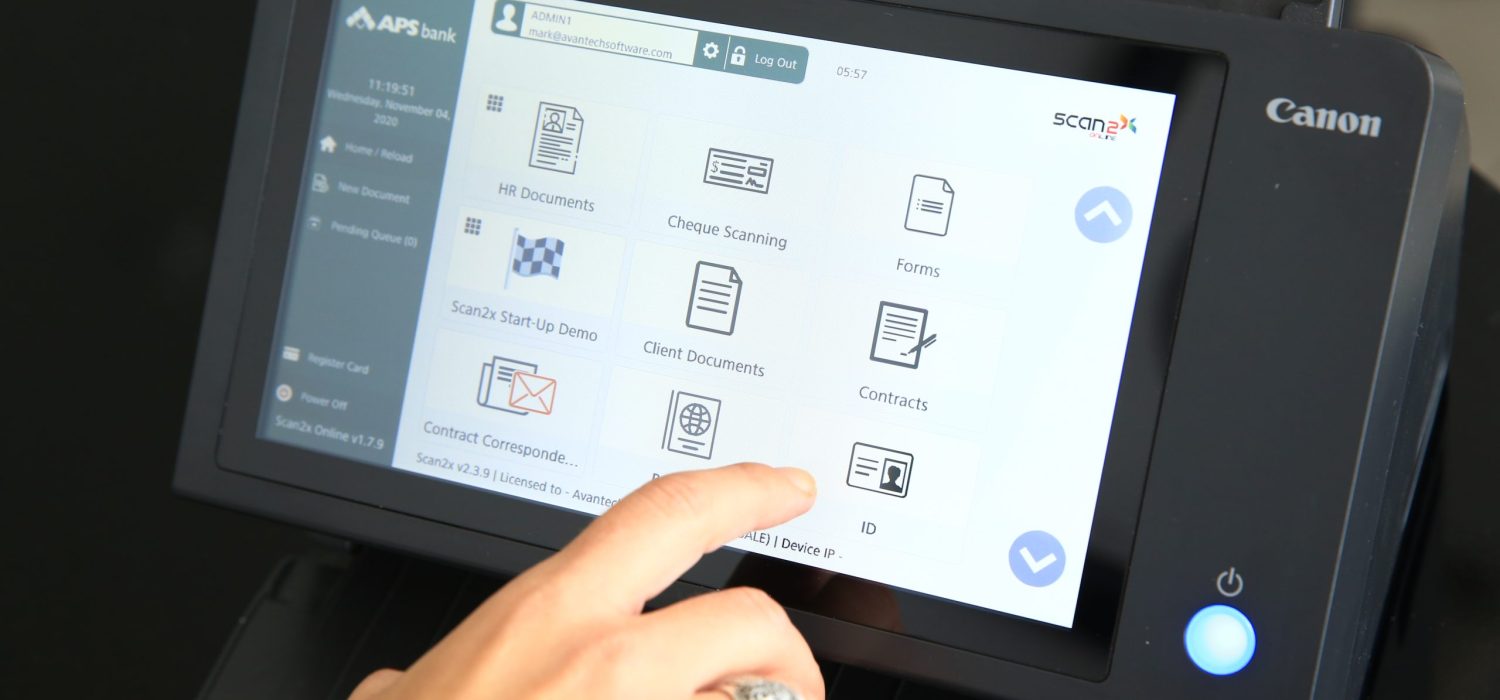

At Avantech, we designed a tailor-made solution, that enabled APS bank to enjoy a seamlessly smooth digitisation process encompassing all the bank’s needs. By combining document digitisation, document generation and Canon hardware, the bank achieves significant gains in efficiency, compliance and costs. In applying the right tech solutions across the bank on all their scanners, PCs and multifunctional devices, the bank can now extend document capture to every user in the bank with no training requirement, offering a smoother and more time efficient services to its client base. Scan2x, PlanetPress and Therefore™ DMS provided by Avantech on Canon Multifunctional devices, PCs and web browsers offer seamless end-to-end workflows anytime and anywhere.

“The technology provided by Avantech and Canon is covering end-to-end processes. The entire solution is improving the processes for our internal users and enhancing, in no small way, our customers’ experience” – Alexander Camilleri, Head of Support at APS Bank

Read the APS case study to learn more on how we’ve helped APS bank automate it’s workflow through digitisation and achieve significant gains in efficiency, compliance and costs.